Project Name

How Ksolves Enabled Smarter Financial Decisions with Agentforce Slack Integration

![]()

A large financial organization aimed to simplify daily decision-making for its analysts, loan officers, and business development teams. With critical financial data distributed across loan management, credit assessment, and ERP platforms, employees spent significant time toggling between dashboards and systems.

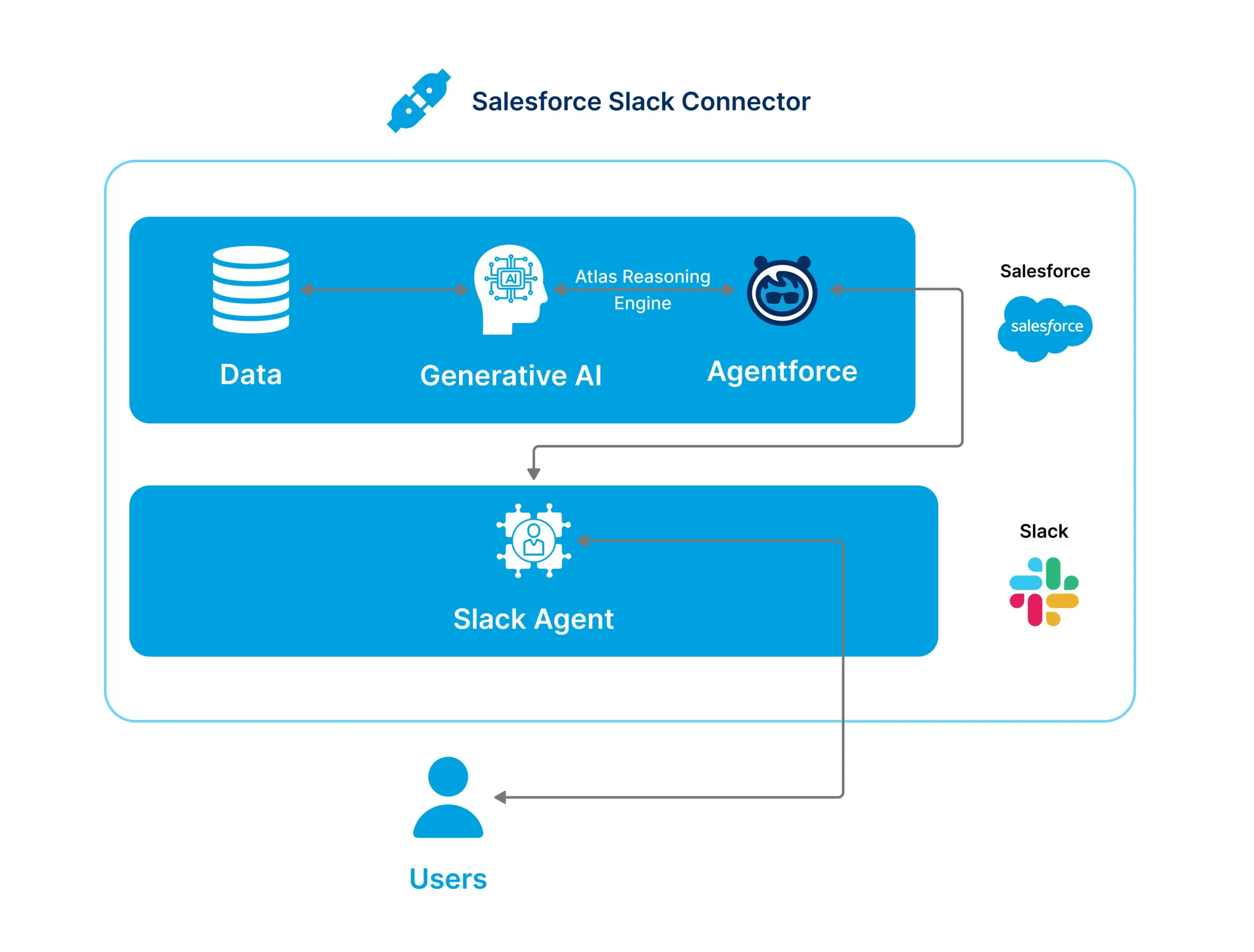

To address this, the company sought a unified solution that could bring all financial insights directly into Slack. Ksolves implemented Agentforce, integrating Salesforce data with Slack to enable secure, conversational access to key financial metrics. This helped streamline workflows and empower teams with real-time intelligence.

The finance organization faced several operational and data challenges:

- Multiple Data Systems: Loan details, payment histories, and market summaries were scattered across different platforms.

- Slow Decision-Making: Loan officers spent hours gathering data for approvals and risk analysis.

- Limited Transparency: Business heads lacked real-time visibility into past dues, performance, and industry trends.

Ksolves deployed a custom Agentforce Slack Agent as a real-time financial assistant designed for internal teams. The integration connected Salesforce, ERP, and credit systems, enabling seamless, AI-powered conversations right within Slack.

- Quick Loan Approval Check: Loan officers can simply ask: “Check the loan approval possibility for customer ID 45789.” The Slack Agent retrieves the customer’s credit score, repayment history, and industry risk index from Salesforce and other financial systems. This helps provide an instant recommendation.

- Past Dues Overview: Finance managers can query: “Show me past dues segmented by industry for Q3.” The agent responds with a structured summary highlighting trends and top delinquent sectors.

- Industry-Wise Financial Summaries: Users can request: “Give me an overview of loan performance in the manufacturing sector.” The agent generates a natural-language report using the latest data and historical KPIs.

- Secure Access Control: Integrated enterprise authentication ensures sensitive financial information is visible only to authorized users, maintaining compliance and data privacy.

The Agentforce Slack Agent delivered measurable business improvements across the organization’s financial operations. By connecting Salesforce data, AI insights, and Slack collaboration, the company achieved significant gains in speed, accuracy, and productivity.

- Reduction in Data Retrieval Time: Information that previously took 12 minutes to compile was now available in under a minute.

- Instant Loan Assessments: Preliminary loan approval checks that earlier took up to 2 days became instant and automated through conversational queries.

- 100% Automation in Reporting: Manual report preparation was replaced with AI-generated summaries delivered directly in Slack.

- 40% Productivity Increase: Teams could focus on decision-making instead of data collection, improving overall workflow efficiency.

By integrating Agentforce with Slack, Ksolves helped the financial organization centralize data access, automate analysis, and accelerate decision-making. The solution enhanced transparency, reduced manual effort, and empowered finance professionals to make informed, real-time decisions, right from their Slack workspace. If you want to learn more about our Agentforce consulting services, contact us at sales@ksolves.com.

Ready to Simplify Financial Decision-Making with Agentforce and Slack?