Anti-Money Laundering with Odoo: Building an AML-Ready Compliance Framework

Odoo

5 MIN READ

February 10, 2026

![]()

Anti-Money Laundering (AML) is no longer limited to banks and large financial institutions. Today, fintech companies, NBFCs, payment service providers, legal firms, trading businesses, and regulated enterprises are all expected to demonstrate strong AML controls. Regulators increasingly look beyond policies and ask a more practical question: Are AML processes embedded into daily operations?

This is where enterprise systems play a critical role.

Odoo ERP is not a certified AML or sanctions screening platform. But it can be configured to act as a foundational system of record and workflow layer that supports AML requirements across customer onboarding, transaction oversight, approvals, and audits.

This blog explains how Odoo supports Anti-Money Laundering compliance in practice, what modules are relevant, and how to use Odoo responsibly as part of a broader AML technology stack.

Understanding Anti-Money Laundering (AML) Requirements

While AML regulations vary by jurisdiction (such as FATF, FinCEN, or EU AMLD), the core expectation remains the same: businesses must prove they are not “willfully blind” to financial crime. To meet these standards, organizations must operationalize several key pillars:

- Customer Due Diligence (CDD & KYC): Implementing mandatory identity verification at the point of onboarding.

- Risk-Based Classification: Segmenting customers into Low, Medium, or High-risk categories based on geography, industry, and transaction history.

- Continuous Transaction Monitoring: Moving beyond one-time checks to flag suspicious spikes or patterns in financial activity.

- Structured Governance: Establishing clear “escalation workflows” where suspicious activity is automatically routed to a Compliance Officer.

- Digital Audit Trails: Maintaining a centralized, tamper-proof record of all approvals, document versions, and communications for at least 5–10 years.

The challenge is not defining these requirements, but operationalizing them consistently across teams, systems, and growing transaction volumes.

Where Odoo Fits in the Anti-Money Laundering Technology Stack

It is important to be precise about Odoo’s role.

Odoo does not:

- Perform sanctions or watchlist screening by default.

- Detect complex money-laundering patterns using behavioral analytics.

- Replace specialized AML or transaction monitoring platforms.

Odoo does:

- Act as a central system of record for customers, vendors, documents, and transactions.

- Enforce process controls and approvals.

- Maintain audit-ready financial and operational data.

- Integrate with external AML tools through APIs.

In short, Odoo enables AML process discipline and traceability, which are essential for compliance.

Odoo Modules That Support Anti-Money Laundering Requirements

While Odoo is not an AML-certified platform, its core modules provide the structural foundation needed to support AML compliance. By combining centralized records, approval-driven workflows, financial traceability, and integrations, Odoo enables organizations to embed AML controls directly into their operational systems.

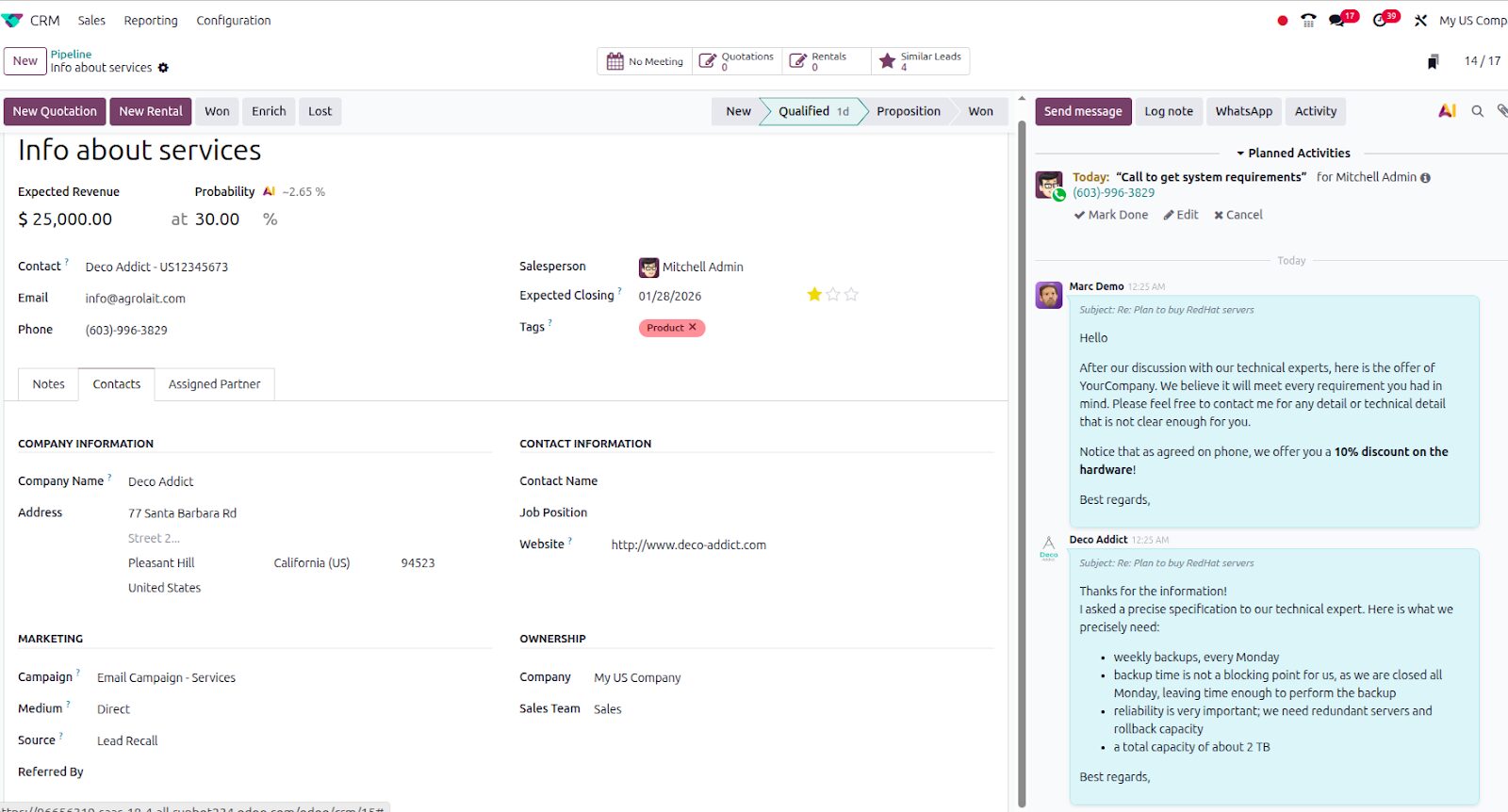

1. Odoo CRM: Customer Onboarding and Risk Profiling

AML controls begin at the point of customer onboarding. Odoo CRM enables organizations to structure and standardize how customer information and early-stage due diligence are captured, reviewed, and approved.

With Odoo CRM, organizations can:

- Maintain a single, centralized customer profile across sales, compliance, and finance teams.

- Capture structured customer attributes, including:

- Customer type (individual or corporate).

- Country of residence or operation.

- Nature of business and industry.

- Configure custom risk classification fields (such as low, medium, or high risk) based on internal AML policies.

- Design stage-based onboarding workflows that prevent customer activation until mandatory information and reviews are completed.

Odoo CRM replaces ad-hoc onboarding practices with a reviewable, auditable, and repeatable onboarding process that aligns with AML expectations.

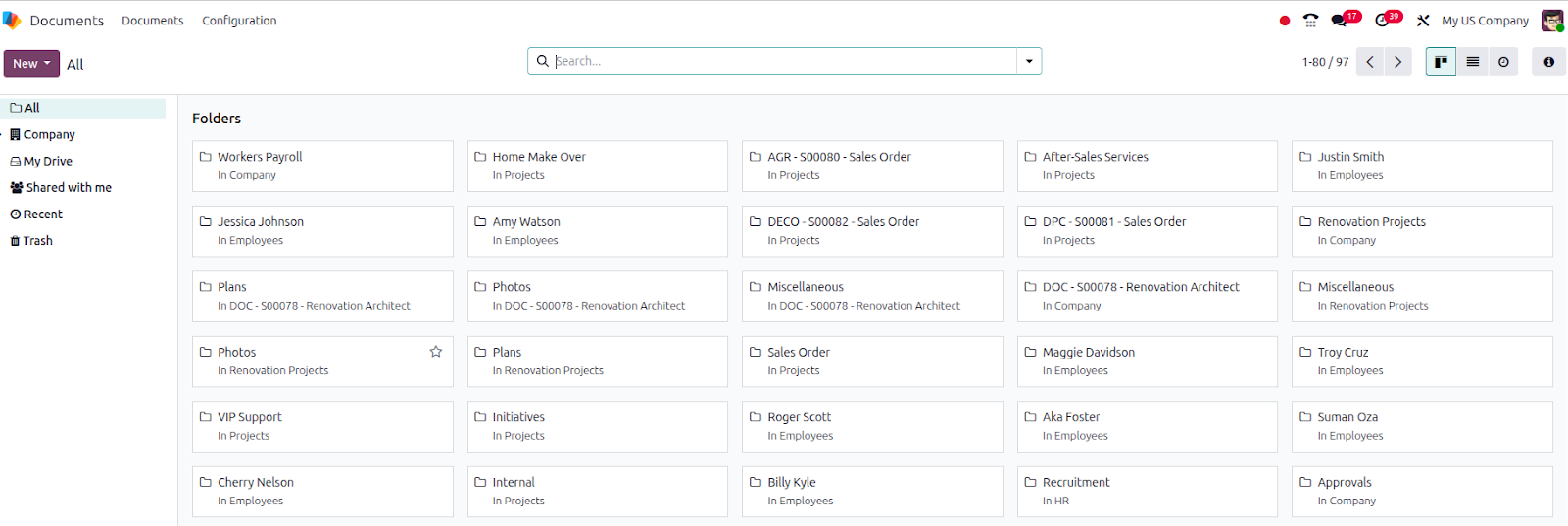

2. Odoo Documents: KYC and Due Diligence Records

AML regulations place strong emphasis on the retention, traceability, and timely availability of KYC and due diligence records. Odoo Documents provides a centralized and controlled repository for managing these compliance-critical assets.

With Odoo Documents, organizations can:

- Securely store identity documents, incorporation records, and beneficial ownership information.

- Link KYC documents directly to customer and vendor records for easy retrieval.

- Enforce role-based access controls to protect sensitive compliance data.

- Maintain document version history to track updates and changes.

- Monitor document expiry dates and trigger reminders for KYC renewals and periodic reviews.

Odoo Documents eliminates fragmented file storage and significantly improves audit readiness and regulatory responsiveness.

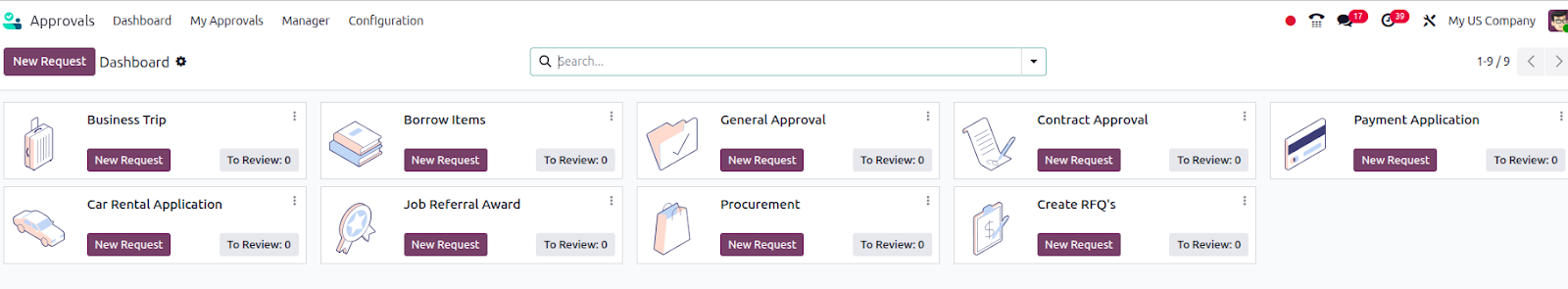

3. Odoo Approvals: Risk-Based Decision Making

AML frameworks require organizations to demonstrate that higher-risk customers and exceptions are reviewed and approved through defined governance processes. Odoo Approvals enables structured, auditable decision-making for such scenarios.

With Odoo Approvals, organizations can:

- Configure multi-level approval workflows for:

- High-risk customer onboarding.

- Exceptions identified during KYC or due diligence reviews.

- Ensure clear accountability by recording:

- Who reviewed and approved the request.

- When the approval was granted.

- The context or conditions under which the decision was made.

These approval records create a transparent audit trail. This is particularly valuable during regulatory inspections, where demonstrating the rationale behind compliance decisions is as important as the decisions themselves.

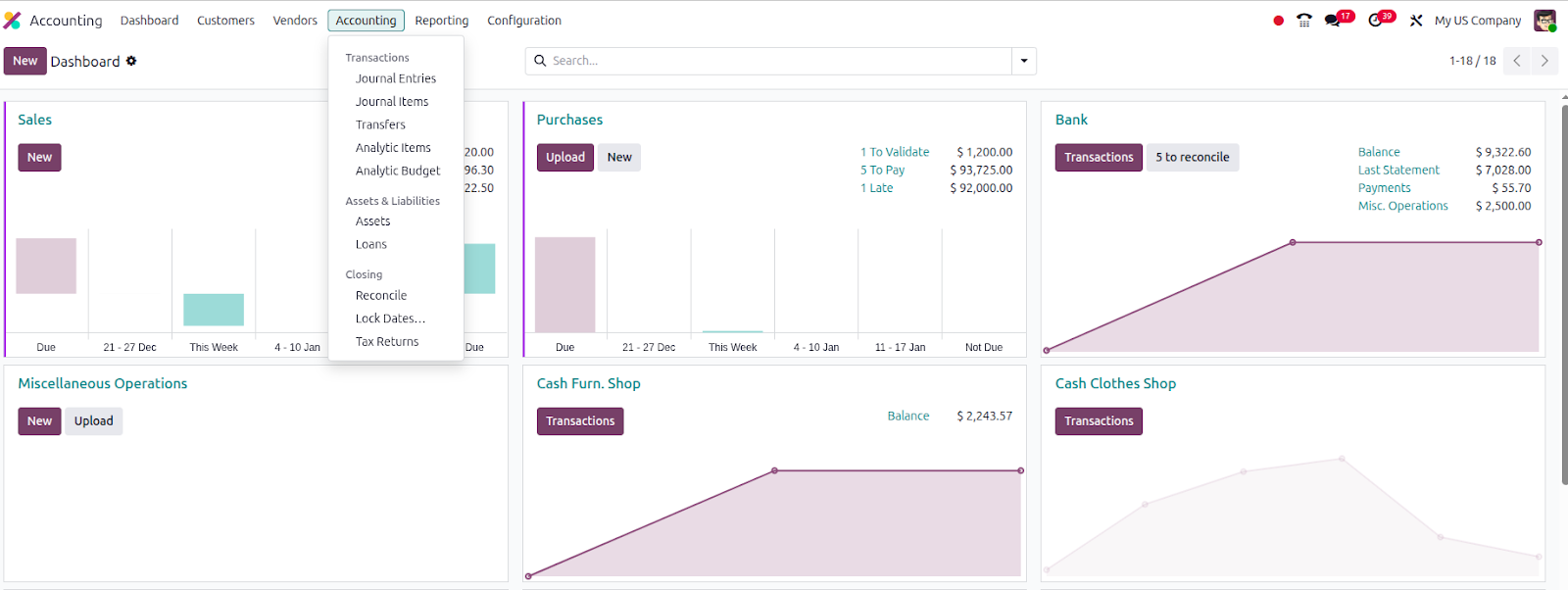

4. Odoo Accounting: Transaction Traceability

Financial transparency and traceability are fundamental AML expectations. Regulators require organizations to demonstrate a clear and consistent link between business activity and financial records. Odoo Accounting provides the structural foundation for this visibility.

With Odoo Accounting, organizations gain:

- End-to-end transaction traceability, linking invoices, payments, and journal entries.

- A unified view of customer and vendor financial activity across the organization.

- Accurate, time-stamped accounting records with controlled posting and approvals.

- Clear alignment between operational transactions and financial reporting.

Odoo does not replace specialized transaction monitoring or behavioral analysis tools. However, it ensures that financial data remains complete, consistent, and audit-ready, forming a reliable basis for AML reviews and investigations.

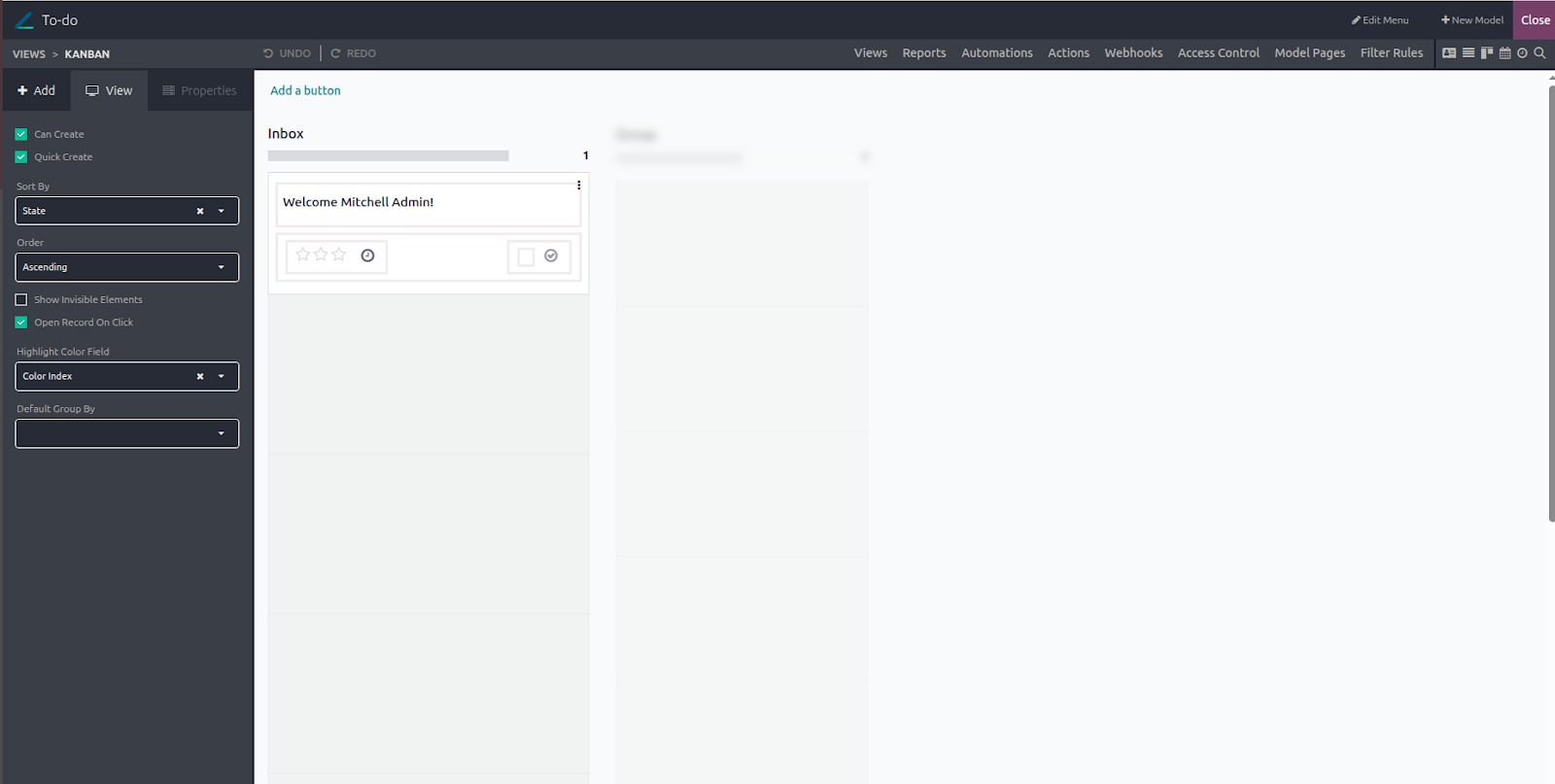

5. Odoo Studio: Custom AML Controls

AML requirements vary across industries, jurisdictions, and organizational risk profiles. Odoo Studio allows organizations to adapt Odoo to their specific AML policies without introducing complex or hard-to-maintain custom code.

With Odoo Studio, organizations can:

- Add AML-specific fields, indicators, and checklists aligned with internal compliance frameworks.

- Configure conditional logic based on customer risk classification or transaction attributes.

- Surface warnings or prompts for high-risk scenarios requiring additional review.

- Adjust onboarding, approval, and monitoring workflows as regulatory or policy requirements evolve.

This flexibility enables Odoo to support risk-based AML controls while remaining scalable, transparent, and maintainable over time.

6. Odoo Automation and Activities: Ongoing Monitoring Support

AML obligations extend beyond onboarding and require continuous oversight throughout the customer relationship. Odoo supports this ongoing discipline through structured, rule-based automation and task management.

Using Odoo Automation and Activities, organizations can:

- Schedule recurring activities for:

- Periodic KYC reviews and document refresh.

- Customer risk reassessment based on internal timelines.

- Configure rule-based alerts for:

- High-value transactions.

- Threshold breaches defined by internal AML policies.

- Automatically assign tasks to compliance teams for review, follow-up, or escalation

These capabilities provide operational consistency and accountability for ongoing AML controls. They are intentionally rule-based and should be viewed as process enforcement mechanisms, not predictive or behavioral analytics tools.

How Ksolves Helps Tailor Odoo for Anti-Money Laundering

Implementing AML controls isn’t just about software but about building processes that actually work in day-to-day operations. That’s where Ksolves, a trusted Odoo implementation partner, comes in. We help businesses tailor Odoo to support Anti-Money Laundering (AML) compliance while keeping workflows smooth and audit-ready.

Here’s how our certified Odoo experts do it:

- Smart Odoo Implementation: We set up onboarding, approvals, and documentation workflows aligned with AML policies, linking transactions and customer data for full audit visibility.

- Tailored Risk-Based Workflows: We configure customer risk classification, conditional approvals, and AML-specific fields and alerts to keep controls effective without slowing down the business.

- Seamless AML Tool Integrations: We integrate Odoo with sanctions screening, identity verification, and transaction monitoring tools. With Odoo as the central system of record, we leverage specialized risk intelligence.

- Ongoing Support & Optimization: We update workflows as regulations or internal policies change, ensuring processes stay scalable, maintainable, and audit-ready as your business grows.

With end-to-end Odoo services, Ksolves helps you turn Odoo into a practical, AML-ready ERP system that works for your business, not against it.

Benefits of Using Odoo for AML Compliance

Implementing AML controls through Odoo helps you meet regulatory requirements. Plus, it streamlines operations, reduces risk, and creates audit-ready processes. Here’s how businesses benefit:

- Centralized Customer and Transaction Data: Keep all KYC, financial, and operational information in one place for better visibility and decision-making.

- Consistent and Enforceable Workflows: Standardize onboarding, approvals, and monitoring so AML controls are applied consistently across the organization.

- Improved Audit Readiness: Maintain complete, time-stamped records and clear audit trails, making internal and external reviews faster and smoother.

- Scalable Compliance Processes: Easily adapt workflows and controls as your business grows or regulations change, without disrupting daily operations.

- Enhanced Operational Efficiency: Reduce manual effort through automation and alerts, allowing compliance teams to focus on high-risk cases rather than routine checks.

- Integration with Specialized AML Tools: Combine Odoo’s operational controls with external risk intelligence for a complete, end-to-end compliance solution.

By leveraging Odoo, organizations can build a practical, sustainable, and scalable AML framework that aligns with business operations while staying regulatory-ready.

Final Words

Implementing effective AML controls is no longer just a regulatory requirement – it’s a critical part of running a transparent and trustworthy business. Odoo provides a centralized, flexible, and auditable platform that helps organizations manage customer data, monitor transactions, and enforce compliance workflows efficiently. When configured correctly, it becomes the backbone of an AML-ready operational framework.

With Ksolves’ expertise in Odoo implementation, customization, integration, and support, businesses can embed AML controls directly into their daily processes. This not only ensures regulatory alignment but also improves operational efficiency, reduces risk, and creates scalable, maintainable, and audit-ready compliance systems.

Connect with our experts and discover how Odoo can become the foundation of your business workflows.

![]()

AUTHOR

Odoo

Neha Negi, Presales and Business Associate Head at Ksolves is a results-driven ERP consultant with over 8 years of expertise in designing and implementing tailored ERP solutions. She has a proven track record of leading successful projects from concept to completion, driving organizational efficiency and success.

Share with